Peak Re | From cybercrime to mental well-being: evolving needs of emerging Asia

November 10 2023

The increasing pace of digitalisation, rapid proliferation of data-collecting devices, and fast adoption of innovative technologies, while increasing productivity and economic growth, have also led to a rise in cybercrime.

The scale of the problem is significant and justifies a more focused approach to protect consumers. According to Peak Re’s 2023 Asia Middle-Class Consumer Survey,[1] 65% of emerging middle-class Asians reported having experienced cybersecurity issues. Although the main concern is financial losses, cybercrimes could disrupt daily lives or result in emotional damage.

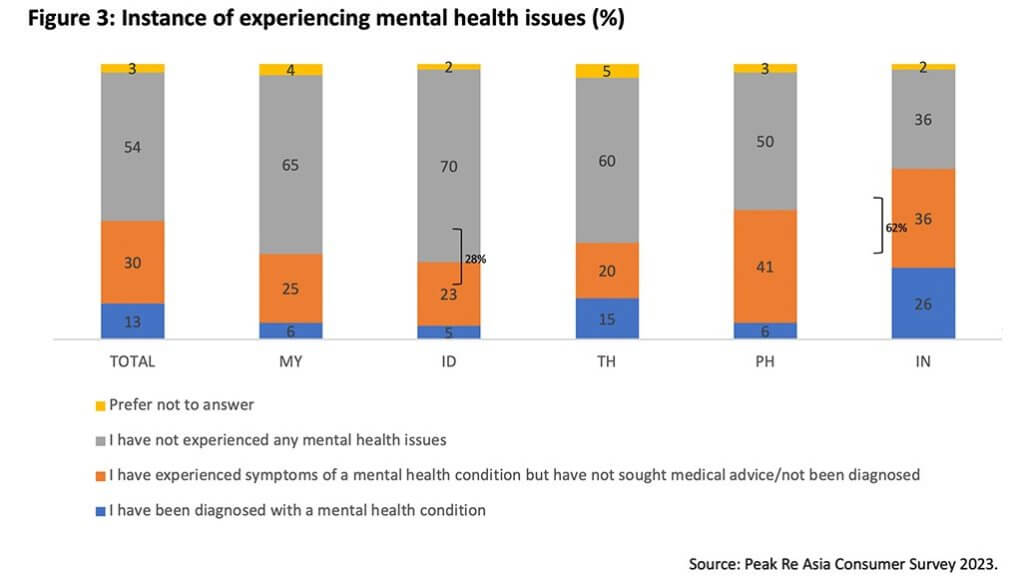

Another emerging protection need is mental health. According to our survey, 43% of emerging middle-class consumers reported some experience with mental health issues. However, only around half of them sought professional treatment. ”Cost of treatment” was the third most cited reason, but the reluctance to seek treatment stemmed largely from the social stigma associated with mental health conditions and doubts about the severity of the condition.

This information is important for insurers looking to provide mental health protection, as consumer education, privacy and confidentiality, and preventive measures are key needs highlighted by consumers.

Rising cybercrime risk from an increasing reliance on technology

According to an estimate by Cybersecurity Ventures, cybercrime is expected to inflict total economic losses[2] of US$8 trillion globally in 2023. Losses are projected to rise steeply, reaching US$10.5 trillion annually by 2025. Asia is particularly vulnerable to cybercrime due to its fast digitalisation and increasing reliance on mobile technologies. Some markets face the challenge of having security infrastructure in place or updated to match the fast-evolving tech landscape. Even the developed markets in Asia are not spared.

According to our latest consumer survey:

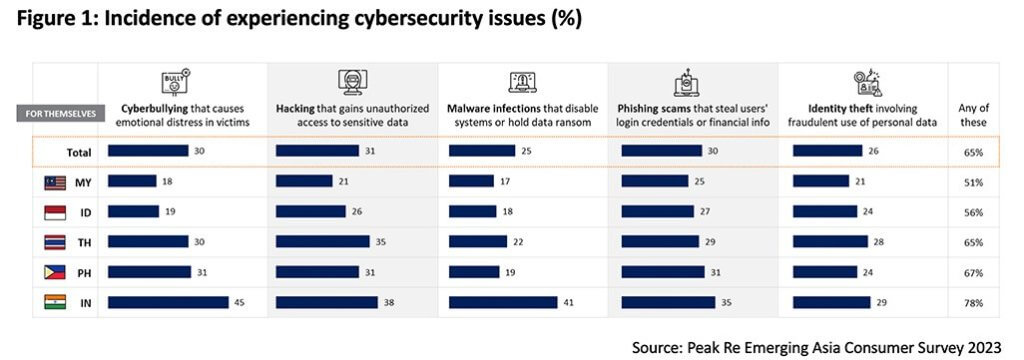

Around a third of respondents reported experience with one of the following cybersecurity issues: cyberbullying, hacking, malware infections, phishing scams and identity theft. The incidence rate (based on having experienced any of the five cybersecurity issues) is high in India, followed by the Philippines and Thailand (see Figure 1).

Respondents are mainly concerned about financial losses from cybercrime. Emotional distress is also a worry in cases of cyberbullying and identity theft. A disruption to daily life and the impact on personal credit ratings were also of concern.

The average financial losses reported by respondents ranged from around US$200 in Thailand to around US$550 in Malaysia and India.

Given the high prevalence of cybercrimes, the need for personal cyber insurance in emerging Asia is significant. Similarly, insurers are increasingly providing value-added services, including access to fraud specialists, active cyber monitoring, lawsuit protection, and replacing or restoring lost data and documents. While victims of cybercrimes could face significant financial losses, emotional distress is also cited as a significant concern, which could affect mental health, a risk that is not negligible.

High and varying prevalence of mental health conditions across Emerging Asia

According to the World Health Organization (WHO), suicide is the fourth leading cause of death among young people aged between 15 and 29. Depression is now recognised as a leading cause of disability.[3] Around 25% of the global population suffers from mental illness at some point[4]. Despite increasing awareness about mental health and the fact that treatment is generally affordable, the prevalence of mental health issues has worsened over the years and two-thirds of people with mental health conditions don’t receive the care they need[5].

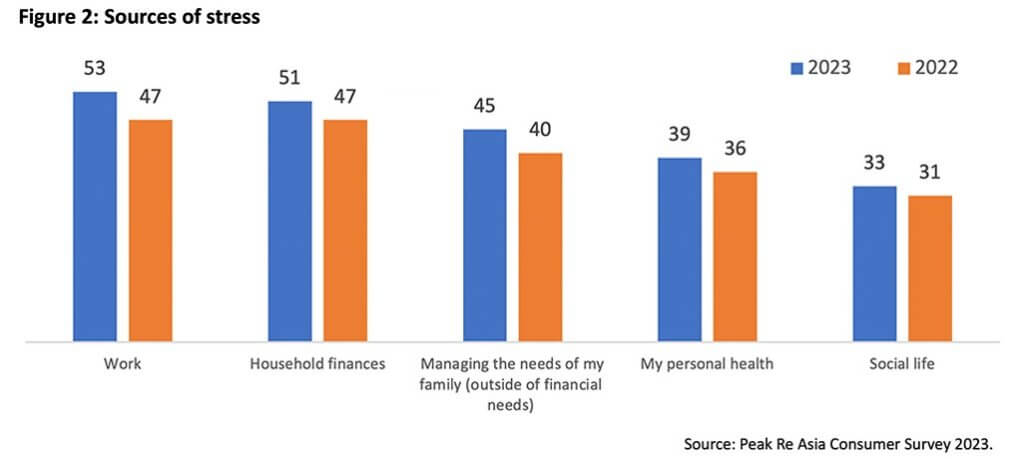

Our survey showed that respondents perceived most stress as coming from work and household finance (see Figure 2). The level of stress, overall and from each of the leading causes, has increased slightly in 2023 from 2022, including stress from managing family’s needs and social life.

Note: Figures refer to the percentage of those who answered 8-10 on a scale of 1 (least stressful) to 10 (most stressful).

Notably, there are significant differences across markets regarding reported stress levels. The survey shows respondents in Indonesia reporting the lowest level of (self-rated) stress and in India the highest (Figure 3).

Depression, anxiety, and mood disorders are the most commonly recognised forms of mental illness, according to our survey. This indicates that consumers tend to consider broader emotional and psychological states rather than strict medical definitions of mental disorders as mental illnesses.

The main concerns associated with mental health issues are the high cost of treatment, followed by an increased risk of suicide, and potential loss of income due to the inability to work. While many of those who have symptoms or are being diagnosed have taken steps to improve their mental well-being, including lifestyle changes or prescription medications, a large cohort has not taken any action. Reasons for inaction include concerns that others will know about their condition or that they do not consider their mental health problems severe enough to require actions.

Conclusion

Technological advancements are imperative to societal advances and economic growth, but the potential risks are also significant. The early concerns are data privacy issues, and more severe threats are later considered such as hackers bypassing a safety system and taking control.

Managing these risks will require a multi-stakeholder approach to risk identification, financing and mitigation. The future of cyber insurance in emerging Asia will depend on further efforts to overcome challenges like the lack of a sufficiently long history of claims data and the identification of fast-evolving threat vectors, agents and actors.

Similarly, the potential scale of the mental well-being issue is daunting and requires the combined efforts of different stakeholders to manage. In particular, the high incidence of non-treatment is a key worry. The perceived high cost of treatment is only part of the explanation. Consumers are mostly worried about being identified with mental health problems or believe that their conditions are not severe enough to warrant treatment. Consumer education and changes in social stigma on mental illness could complement insurance solutions in helping to manage the rising issue of mental illness in Asia.

[1] The five markets are India, Indonesia, Malaysia, the Philippines and Thailand. Samples are selected based on household income to focus on the “middle-class”. The full report, covering a range of key insurance topics, including mental wellness, critical illness, and cybersecurity, will be available on Peak Re’s website in November 2023.

[2] Cybercrime costs include damage and destruction of data, stolen money, lost productivity, theft of intellectual property, theft of personal and financial data, embezzlement, fraud, post-attack disruption to the normal course of business, forensic investigation, restoration and deletion of hacked data and systems, and reputational harm. See 2022 Official Cybercrime Report, eSentire and Cybersecurity Ventures.

[3] Mental Health, the World Health Organization, https://www.who.int/

[4] The Global Mental Health Crisis, Project Hope, https://projecthope.org/

[5] The Global Mental Health Crisis, Project Hope, https://projecthope.org/

|

Clarence Wong

Chief Economist, Peak Re

Email: [email protected] |

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital