QBE | Building supply chain resilience for business sustainability

August 30 2023

Asia, as one of the most important components of the global supply chain, experienced significant disruptions during Covid-19. The region’s supply chains were hit by a combination of a challenging export environment, rising inflation, increased wages, higher energy prices, labour shortages, and adverse weather.

The pandemic tested the robustness of supply chains and exposed vulnerabilities in the global supply chain. Companies had to navigate Covid protocols and take on unusual risks. Transportation of vaccines requiring freeze drying and containers to maintain a certain temperature; global semiconductor shortage magnified by the ‘stay-at-home economy’ and the Suez Canal blockage in March 2021 were notable challenges during the period.

The pandemic has also alerted companies to the need to diversify their manufacturing and reduce the world’s reliance on China. Since then, some companies have tried to move some of their manufacturing bases to other Asian economies such as India, Vietnam and Malaysia. Most notably, Apple decided to partially produce MacBooks in Vietnam and iPhones in India.

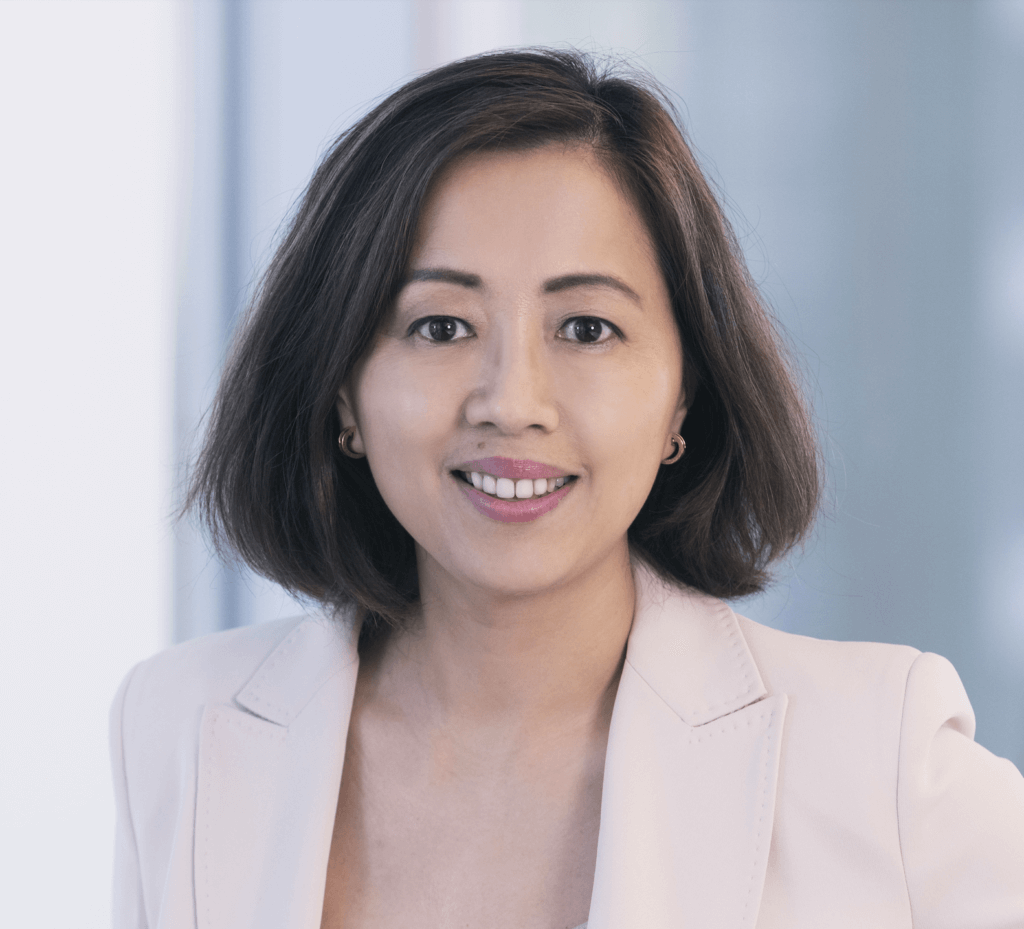

“We understand the crucial role that effective risk management plays in all organisations and work hard to understand our customers’ businesses so that we offer insurance solutions that minimise their risk exposures while simultaneously building up their business resilience and sustainability.” Lei Yu, North Asia CEO, QBE Insurance

Identifying risks

Risks need to be managed carefully across the supply chain. Companies should work as closely as possible with their insurers to navigate a complex global ecosystem across different geographies.

“As economies open up post-Covid, companies have had to react to changes in supply and demand, which has also been affected by the present economic outlook,” said Lei Yu, North Asia CEO for QBE Insurance.

“We understand the crucial role that effective risk management plays in all organisations and work hard to understand our customers’ businesses so that we offer insurance solutions that minimise their risk exposures while simultaneously building up their business resilience and sustainability,” she added.

“A part of this solution is the ability to identify PESTEL risks,” Yu noted.

PESTEL is an acronym for political, economic, social, technological, environmental and legal risks.

Political risks include examples such as the Russia-Ukraine war, economic risks are events such as changes in GDP outlook that impact trade flows, social risks could be demands for higher wages, examples of technological risks are cyberattacks, risks from use of blockchain in shipping, environmental risks include incidents like major oil spills, and legal risks come from trying to meet environmental targets such as through the type of fuel used.

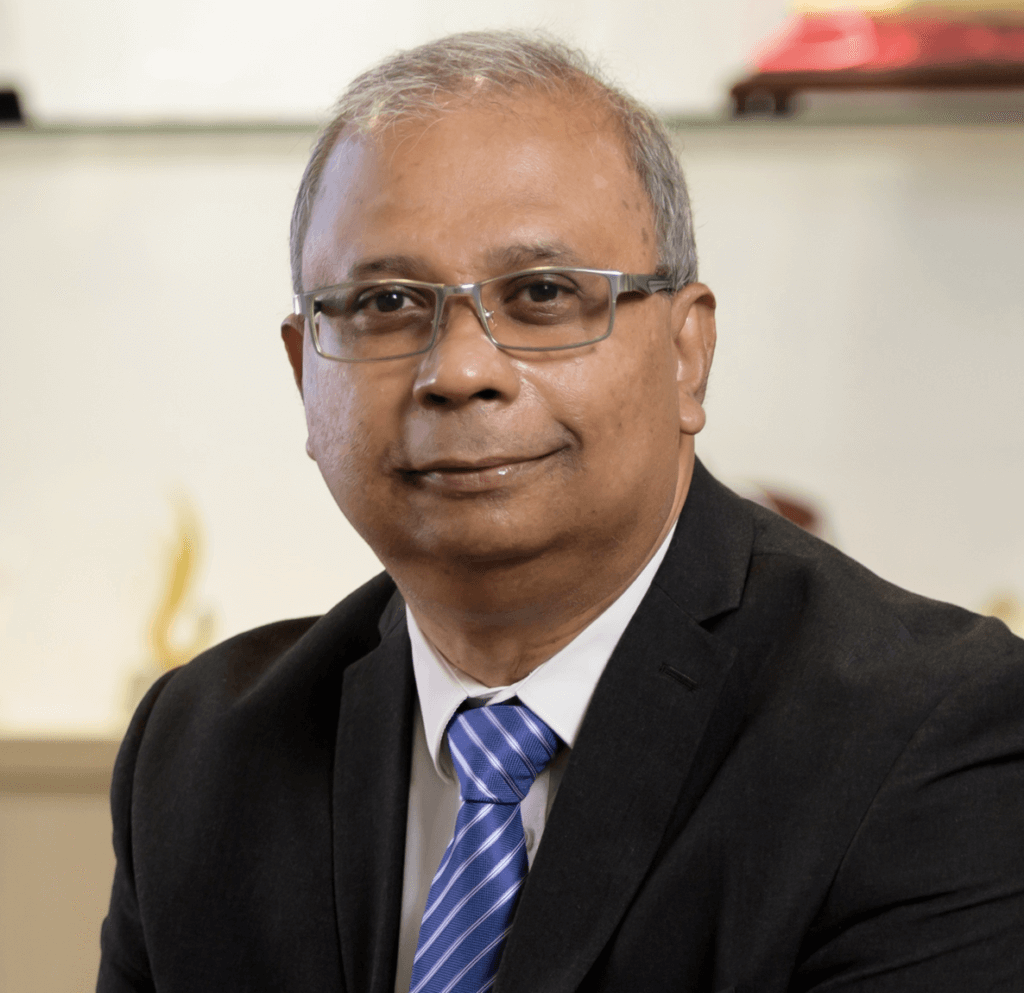

“Firms can order supplies and track them electronically, but in most cases these goods still need to be physically delivered. Digital tools help in managing and understanding supply chains, but don’t eliminate the fundamental risk drivers.” Rama Chandra, Asia head of marine, QBE Insurance

Understanding risks

Supply chain management is inherently complex, especially in an age of increasing geopolitical and financial uncertainty. While risk managers have been historic champions of supply chain risk management, it is now increasingly central to the needs of the procurement, operations and distribution teams.

For example, Hong Kong is a global shipping hub, so freight and logistics are key risks. Falling exports, rising inflation, higher wages, a shortage of labour and adverse weather such as typhoons also add to supply chain risks.

Singapore’s supply chain is heavily dependent on imports and the smooth running of global trade. The nation is reliant on China for the imports of electronics, machinery, and metals for construction and manufacturing.

Increasing digitalisation has also exposed supply chains to newer risks such as that of cyberattacks.

“Digitalisation is an important accelerator in supply chain operation, but it doesn’t change physical delivery,” notes Rama Chandran, head of marine underwriting at QBE Insurance.

“Firms can order supplies and track them electronically, but in most cases these goods still need to be physically delivered. Digital tools help in managing and understanding supply chains, but don’t eliminate the fundamental risk drivers,” he added.

Minimising risks

Companies can take proactive measures to reduce their exposure to supply chain risk and build supply chain resilience. Here is a checklist that firms can use to reduce their risk exposure.

Open communication lines with suppliers. An active dialogue with suppliers is the best defence against unexpected shocks. Whether it is informal or systematic, information could prove invaluable by providing warnings before shocks appear.

Take a long-term view. Uncertainty, and the resulting potential for business disruption, has become the norm rather than the exception. Taking a long-term view and working with suppliers through difficult periods will strengthen networks over time.

Focus on risk culture. Understanding the risk culture helps build the firm’s risk intelligence and its ability to deal with uncertainty.

Financial precautions. Ensuring suppliers have sufficient coverage and/or resources to weather a business failure in the network and that the cost of disruption is factored into inventory planning.

Manage cyber exposure. Technology, big data, blockchain – of which insurance contracts can be a part – and more advanced communications are playing an increasing role in supply chain management and making sure they are protected from cyber threats is crucial.

Real-time risk management and tracking. Monitoring ships’ locations and cargo in real time can help reduce theft and help with “real-time compliance” and provide better information regarding losses.

Understand supplier alternatives. Building relationships with a wider set of suppliers and distributors can help in the event of shocks.

Prepare for the worst. The best way to minimise shocks to supply chains is being prepared for the worst. Scenario planning is extremely important in a rapidly shifting risk environment.

|

Lei Yu,

North Asia CEO and Regional Head of Distribution, QBE Asia

Email: [email protected] |

|

Rama Chandran,

Head of Marine, QBE Asia

Email: [email protected] |

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital