Zurich | Aligning your climate resilience strategy with evolving disclosure requirements

June 2 2023

As our planet faces the critical global challenge of climate change, its impacts are increasingly felt across ecosystems, economies, and societies. Scientific predictions indicate that we are on the brink of surpassing a vital temperature threshold soon.

The severity of this issue was vividly demonstrated in April, particularly in Asian countries like Bangladesh, India, Laos, and Thailand, when unprecedented heatwaves swept across these countries breaking temperature records. These extreme heat events serve as poignant reminders of the escalating consequences of climate change.

Climate disclosure trends in Asia

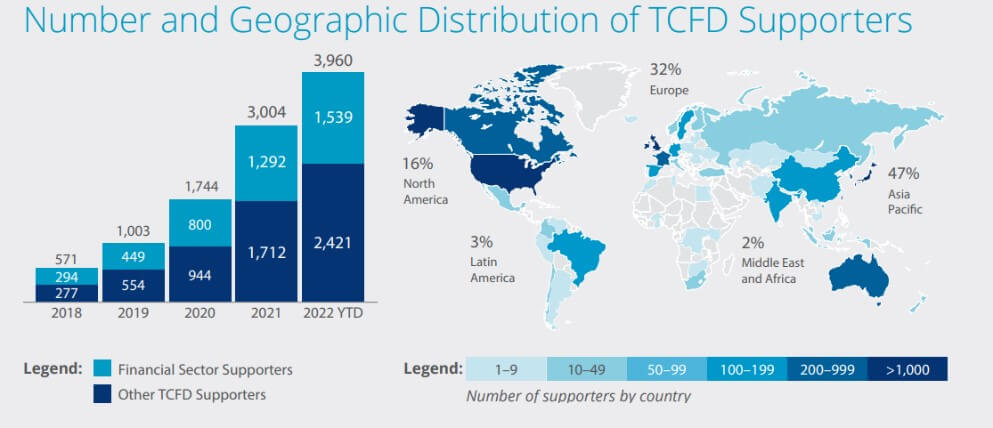

Climate change disclosure and transparency have become increasingly critical. The Task Force on Climate-related Financial Disclosures (TCFD) recommendations, established by the Financial Stability Board (FSB), are widely recognised as the globally accepted guidance for climate disclosures by regulators and policymakers.

This need is particularly evident in Asia, where a growing awareness of climate-related risks is taking hold. The TCFD Status Report in 2022 reveals that 47% of all TCFD supporters originate from the Asia Pacific region. This significant representation can be attributed, in part, to the tightening regulations enforced by Asian regulators.

(Source: TCFD Status Report 2022)

Jurisdictions such as Hong Kong, Japan, Singapore, India, Malaysia, and Thailand are at different stages of advancing the climate disclosure requirements agenda. They recognise the significance of transparent reporting on climate risks and are actively working towards implementing comprehensive disclosure frameworks. By promoting greater transparency and accountability, these regulatory efforts aim to ensure that businesses in Asia effectively address climate-related challenges and contribute to global sustainability initiatives.

Reporting as the result, not the purpose

Instead of merely focusing on how to comply with disclosure requirements, the crucial question to ask is how to build climate resilience. Treating climate reporting as a mere checkbox exercise may not yield meaningful information if companies fail to take proactive measures in managing their climate risks. It is essential for businesses to prioritise action and risk management alongside reporting to effectively address the challenges posed by climate change.

Building a robust climate resilience journey

To establish a robust climate resilience journey, a four-step approach is suggested:

- Identify. Begin by comprehending the risks your business faces. Understand how and where your organisation is most vulnerable to the physical impacts of climate change. Visualise the potential evolution of these exposures across various climate scenarios.

- Prioritise. Optimise your climate risk adaptation efforts by prioritising objectives. Determine which areas require immediate attention and additional investment to enhance resilience effectively.

- Act. Conduct comprehensive assessments of both physical and operational risks at your most critical and vulnerable locations. Develop strategies to enhance resilience at these sites and implement the identified measures promptly.

- Communicate. Share your progress and initiatives through recognised reporting frameworks like TCFD and other applicable regulations.

By following these steps, businesses can build a proactive approach to climate resilience, enabling them to mitigate risks and adapt to the challenges posed by climate change.

At Zurich, we are committed to supporting our customers throughout their climate resilience journey, going beyond mere reporting. Our team of experts collaborates with organisations to develop tailored solutions, leveraging data and insights to assess climate risks and implement effective adaptation measures. We believe in a comprehensive approach that encompasses risk assessment, risk management, and compliance with reporting frameworks. By partnering with Zurich, businesses can proactively address climate challenges, reduce the frequency and severity of climate-related events, and navigate the evolving regulatory landscape. Together, we can build a resilient future and make a positive impact on our customers and communities.

|

Ken Yuen

Climate Change and Sustainability Risk Consultant

Email: [email protected] |

-

QBE | Elevating customer experience, humanising claims: QBE Asia’s ‘Solutions in a Box’

Vastly improving turnaround times and personalising service delivery, QBE Asia’s award-winning, end-to-end bundled claims solutions is a game-changer for the insurance industry.

-

Beazley | What does cyber protection look like from day 1 to day 600 and beyond?

Cybersecurity is no longer just an IT concern, but a governance issue that belongs on the boardroom agenda.

-

Sedgwick | Preparing for the next storm

Insurance industry needs to recalibrate, invest in innovation and strengthen systems, talent and data practices.

-

Peak Re | From climate modelling to market opportunity: Forging a new clarity on Southeast Asia’s climate risk

Southeast Asia's protection gap: a crisis of clarity, not just capital