Get full access

To view the full article and get unlimited access to InsuranceAsia News's exclusive insight across 5,000+ articles

Already a Subscriber? Please Login

As APAC’s movers and shakers prepare to gather for the 21st Singapore International Reinsurance Conference (SIRC), we provide a snapshot of the hot topics that will be on peoples’ lips this year.

Underpinning most of the discussions at the conference will be the most important dynamic of them all for the majority of practitioners: the embeddedness of the soft market.

Yes, the H1 claims experience has not been pleasant – according to Munich Re, for example, worldwide, natural disasters caused overall losses of around US$131 billion in the first half of 2025 (2024: US$155 billion), of which US$ 80 billion was insured, dominated by the Los Angeles wildfire losses and the Myanmar earthquake.

Yet so far it would be fair to say that H2 has not really delivered any nasty surprises.

The North Atlantic hurricane season has been relatively benign, and in Asia in Q3 the only events which have exceeded US$1 billion in insured losses have been seasonal floods in China, Tropical Storm Wipha in Asia and Southeast Asia, and the Punjab floods in India and Pakistan.

With reinsurance industry capital having increased to US$720 billion in the first quarter of 2025, according to Aon, having reached a new high of US$715 billion in 2024, and driven by the retained earnings of established reinsurers, it’s all clear that this is once more a well-supported, keenly competitive marketplace.

Putting all this together means that reinsurance brokers are once again firmly back in the driving seat and will be the market makers for upcoming APAC renewals, setting the tone and more importantly guiding discussions around pricing, structure and terms and conditions.

Expect multi-year deals, expanded coverage, and structured solutions to be very much in play.

With attractive returns harder to come by, investors in the Asia (re)insurance market will be getting increasingly twitchy in 2026 and will be demanding that boards come up with some attractive proposals that go beyond quarterly dividends.

After a bit of lull in the M&A space in the region in recent years, expect deal-making to uptick next year. And keep a careful eye out at SIRC for who is sneaking off with who!

Parametric insurance is one of those tantalising topics that have promised so much for so long but, let’s be honest, have never really set the world alight, especially in Asia.

Yet one gets the sense that now is the time for parametric to finally break through to the mainstream.

The technology appears to be there, the brokers are on board, and more importantly investors are getting their heads around it as parametric covers expand beyond their traditional agricultural base to become a more interesting tool for the APAC market.

Regulation often takes a backseat at the industry’s major conferences, but I have a feeling that this will change at SIRC given the timing of the Australian Prudential Regulation Authority (APRA)’s release of its paper, ‘Targeted adjustments to the general insurance reinsurance framework’.

Ok, that may not sound thrilling, but actually this could be a game changer as it is proposing an overhaul of the country’s general insurance market which is intended to provide a significant boost to the country’s underweight alternative reinsurance sector, including a proposal which would remove reinstatement requirements for reinsurance arrangements where reinstatements are typically unavailable, such as catastrophe bonds, to improve access to alternative forms of reinsurance. ILS, here we come!

At Monte Carlo, one of the key topics was the impact of AI on the wider industry, and I’ve no doubt that this will be an important topic at SIRC at well.

For the (re)insurance market, AI continues to be a double-edged sword: on the one hand, it offers the possibility of innovative risk assessment and radical modelling; on the other, it continues to pose the threat of job losses. How it will pan out in the technology-leading APAC region will be fascinating.

It’s lovely to be back in Singapore once again for the Singapore International Reinsurance Conference (SIRC), now in its 21st year and firmly embedded as of the core events in the (re)insurance conference calendar.

But don’t just take my word for it – I note that the conference is now taking place on two floors of the sizeable Sands Expo & Convention Centre, which speaks volumes.

The official tagline of this year’s SIRC is “Staying Ahead, Future Ready” and it’s one that has grabbed me, because it’s a bit of a pet gripe of mine that the market too often is comfortable writing the same old historical covers, assuming risk that it is technically on top of, with just the right amount of volatility in the book to not scare investors away.

Of course, this makes sense in so many ways.

But I do wonder, in a region which is undergoing, and in many cases, leading the charge on digital transformation, is there a danger that the (re)insurance market’s embedded conservatism at such a crucial juncture in history will be seen as a real missed opportunity? I really hope not.

The big opportunity here, of course, relates to cyber (re)insurance.

If the market gets this right, surely before too long cyber will take its place at the top table of risk in terms of premium volume?

Yes, yes, I hear you say, brokers have been talking up this space for donkey’s years now, but the figures don’t match the rhetoric. In any case, you might add, the price point of late has scared off a fair few buyers, especially in other regional markets.

And you’d be right. Cyber has not really delivered in terms of the top line as many of us thought it would. But at least efforts are being made.

It is extremely encouraging, for example, that as SIRC 2025 kicked off, Gallagher Re has launched a cyber reinsurance facility, with an initial line size of at least US$15 million for facultative placements, and US$10 million for treaty and white-label deals. Bravo!

I should add that I’m really looking forward to catching up with many of you once again at this year’s SIRC.

If we haven’t managed to schedule an official diary slot, do feel free to grab me if you see me around the convention centre.

Wishing all of you a pleasant, informative and productive few days here in Singapore.

Asia lies at the heart of Lloyd’s growth plans over the next few years, with considerable opportunities for a number of specialty markets, including construction, marine cargo and contingent business interruption underwriters, according to CEO Patrick Tiernan.

Tiernan was delivering the keynote opening address at this year’s 21st Singapore International Reinsurance Conference (SIRC) in what was also his first major speech in Asia since becoming Lloyd’s new CEO in May.

“When I think of Asia it’s simple for me because I can just use the rule of 10,” he told delegates.

“Lloyd’s GWP in Asia Pacific is about US$10 billion. We are growing – the compound annual growth rate over the last three to four years is just under 10%. Singapore represents about 10% of our presence here, which is a billion US dollars.

“And the region represents roughly 15% of everything we do at Lloyd’s. It is our fastest growing region by quite a clip and Singapore is of course at the epicentre of it.”

He said that there are now 16 managing agents on the Lloyd’s Singapore platform, with strong growth and strong combined ratios over the past couple of years, though he conceded that this has also attracted more competition.

Nonetheless, he presented a confident assessment of the opportunities that Asia can provide for Lloyd’s, stressing that London and Singapore can continue to develop a mutually beneficial working relationship.

“There is much room to build beyond the core … Singapore isn’t a branch of London, it’s Lloyd’s regional hub: a bridge connecting Asia’s biggest economies with global capital,” he said. “Our ambition is to make Lloyd’s more efficient, more relevant, and more confident in tackling new forms of risk in the region.”

It’s not all rosy in the garden, however, with Tiernan also accepting that Lloyd’s can make greater strides to facilitate growth in Asia, adding that “operationally we do much more, we know that … we can simplify access, we can speed up processing, and we can build the digital tools necessary to match how the region does business”.

“Here in Singapore with are working with the [Monetary Authority of Singapore] and others to align on regulation, on data, and on digital enablement. And that’s how we’ll strive to make placement faster, cheaper and safer, and how we make Lloyd’s the market feel local and not distant,” he added.

“What we want is partnership: your local flavour, your local knowledge, blended with the capital efficiency and structuring power that Lloyd’s provides.”

He noted, “as we all know” that Asia is very far from homogenous, and is instead “an extraordinary mosaic of different economies on different growth trajectories, each with its own regulatory framework, its own market maturity and its own insurance culture. But if we get the balance right, we get something really powerful: an ecosystem that combines financial strength and global each with global insight”.

Tiernan was also bullish about the wider prospects for economic growth in Asia, noting that at present the region provides some 42% of global GDP, but that by 2030, that figure is projected to rise to some 52%, with the construction of new data centres, roads, ports and rail projects all giving rise to potential insurance clients.

He also suggested that the growing importance of trade routes in the region also provides considerable opportunities for Lloyd’s Asia in a number of areas, including marine cargo and contingent business interruption insurance, taking into account the current difficulties caused by political instability.

Global reinsurer Hannover Re continues to see opportunities in both emerging and developed markets in Asia Pacific, Hannover Re executive board member Sharon Ooi told InsuranceAsia News.

“We look to deploy more capacity if required by our clients and expect robust discussions leading up to renewals,” Ooi said ahead of the Singapore International Reinsurance Conference.

“Southeast Asia remains an incredibly dynamic market with prices depending on the loss experience after the catastrophes we’ve seen in the past.

“For us, price adequacy remains a focus, and we are also seeing an increased trend of introspection by cedents to revisit the sufficiency of cat limits especially after the earthquake in Myanmar and Thailand,” she added.

Discussing the reinsurance giant’s appetite for Asian risks, especially considering Hannover Re’s premium growth was flat at 1.1 2025, due to lower primary rating increases, Ooi said: “The rate adequacy on the primary market does remain a concern, more impacting the proportional treaties, and we look to engage in dialogue with our clients to better manage the portfolio through risk selection, with focus on a sustainable growth together.”

Ooi, who has regional responsibility for Asia Pacific and Sub-Saharan Africa and includes facultative reinsurance, said that the consolidation in major Asian markets like Australia and Japan “will result in less contestable reinsurance premium”.

She added: “The clients’ focus on volatility and capital management will open different opportunities for reinsurers and we have the right offering and experience to accommodate these demands.”

Hannover Re said it had adjusted its client-specific and product-specific appetite in Asia Pacific at the January 1, 2024, renewals due to the lower primary rating increases in the region.

The reinsurer’s P&C premium growth in the region for the 1.1 renewal was a muted 0.8% at EUR1.22 billion (US$1.4 billion) compared with EUR1.21 billion in 2024.

“First and foremost, we want to support our clients achieving their goals. Be it on their traditional core reinsurance programmes or with more specialised solutions.”

Sharon Ooi, Hannover Re

Hannover Re’s Asia Pacific gross P&C reinsurance revenue for 2024 was down 4.5% to EUR2.7 billion compared with EUR2.83 billion in 2023, the company said in its annual earnings report.

While it grew its business in Australia by 8.7% to EUR741 million in 2024 from EUR681.4 million a year ago, Asia revenues fell to EUR1.9 billion from EUR2.1 billion over the same period.

Its treaty business revenue in the region also fell by 4% year-on-year to EUR1.9 billion compared with EUR2.1 billion in 2023

Gross reinsurance revenues, including life and health, for the region stood at EUR4.59 billion, up marginally from EUR4.57 billion in 2023. Revenues from Asia for the period were EUR3 billion, while Australia accounted for EUR1.5 billion.

Ooi said: “First and foremost, we want to support our clients achieving their goals. Be it on their traditional core reinsurance programmes or with more specialised solutions.”

“We continue to see more opportunities than challenges as our clients mature and we deepen our relationships. This will result in more open and strategic discussions around how to help them navigate a continued dynamic market environment affected by volatility resulting from climate change as well as the financial markets.”

Reflecting on the region’s outlook in its March earnings call, the reinsurer had said: “While we are seeking to maintain our strong market position in traditional property and casualty business, we aspire to play a stronger role in the region’s market for catastrophe covers to cater to the increasing frequency of natural disasters and the large protection gaps that still remain.”

Opportunities for serving the protection needs in Southeast Asia will continue to expand due to a large and growing middle class, a growing physical capital stock as economies industrialise and urbanise, and from increasing climate stress, Chia Der Jiun, managing director of the Monetary Authority of Singapore (MAS), told delegates on the opening day of the Singapore International Reinsurance Conference.

“Singapore’s insurance market has grown with the region’s protection needs. The industry saw robust growth over the past five years, 2019 to 2024, employing a workforce of around 19,000 individuals over this period,” he said in his keynote address at the Sands Expo & Convention Centre in Singapore.

According to Chia, total life, general insurance and reinsurance premiums grew at an average of over 8% annually to reach about SG$78 billion (US$59.85 billion) at the end of last year.

“Leading global insurance players are anchoring high-value-adding capabilities and activities in Singapore,” he added.

“Insurers are growing their headquarters or regional functions in Singapore, driven by structural and strategic considerations.

“Specialty insurance lines and reinsurance capacity are growing to cover large and complex risks in this region.

“Global brokers are also accurate capabilities in analytics and advisory, risk modeling, and sustainability in Singapore.”

Chia highlighted three specific areas of opportunity where MAS hoped to further collaborate with the industry, namely harnessing AI and data, infrastructure financing opportunities in the region and growing need for climate risk coverage.

He added that MAS would continue to support the growth of the mainstream insurance market to service the region’s needs.

“We support international insurers and reinsurers to scale capacity and deepen their operations and underwriting expertise here, undergirded by a robust regulatory framework that facilitates innovation,” he added.

“At the same time, the alternative risk transfer market can play a complementary role. The alternative risk transfer market expands the overall capacity and strengthens resilience to large-scale shocks.

“Insurance-linked securities are increasingly being used to allow capital market participants to share the risk of insurance perils.”

Compared to the US, where ILS has become an important source of risk capacity, particularly to help manage the financial impact of hurricanes, the market in Asia remains nascent, he added.

“The current ILS penetration in the region is modest,with limited issuance and adoption by insurers, reinsurers, and investors,” he said.

“Singapore’s deep and diverse risk management ecosystem allows us to serve as a regional center for risk financing and alternative capital.”

MAS has supported the issuance of 29 catastrophe bonds to date, covering perils such as storms, earthquakes, and floods globally and in the region, according to Chia.

“As financial markets in the region continue to grow, the potential investor base for ILS is broadening,” he added.

“ILS provides attractive, stable returns that are typically uncorrelated with other asset classes.

“This makes it an attractive instrument for institutional investors to seeking to diversify their portfolios in the region.

“ILS also provides a way to align investments with climate-resilient goals, making it an increasingly attractive investment in Asia’s growing focus on green finance and sustainability.”

With climate risk growing globally, including in Asia, MAS expects continued momentum in the growth of ILS alongside reinsurance capacity in the region, with more countries and businesses seeking greater protection from catastrophic risks.

“Hence, to support the growing demand for risk transfer solutions, particularly in Asia, MAS has refreshed the ILS grant scheme to offset issuance costs,” Chia added.

“To encourage broader market participation and innovation, we will extend our support to cover non-APAC risks and renewals, while continuing to prioritize support for insurers that directly address protection needs within the APAC region.

“MAS will also work with the industry to attract and catalyze demand for ILS in Singapore.

“We welcome sponsors and asset managers and owners that are keen to establish ILS structuring or investment teams here to engage MAS directly.”

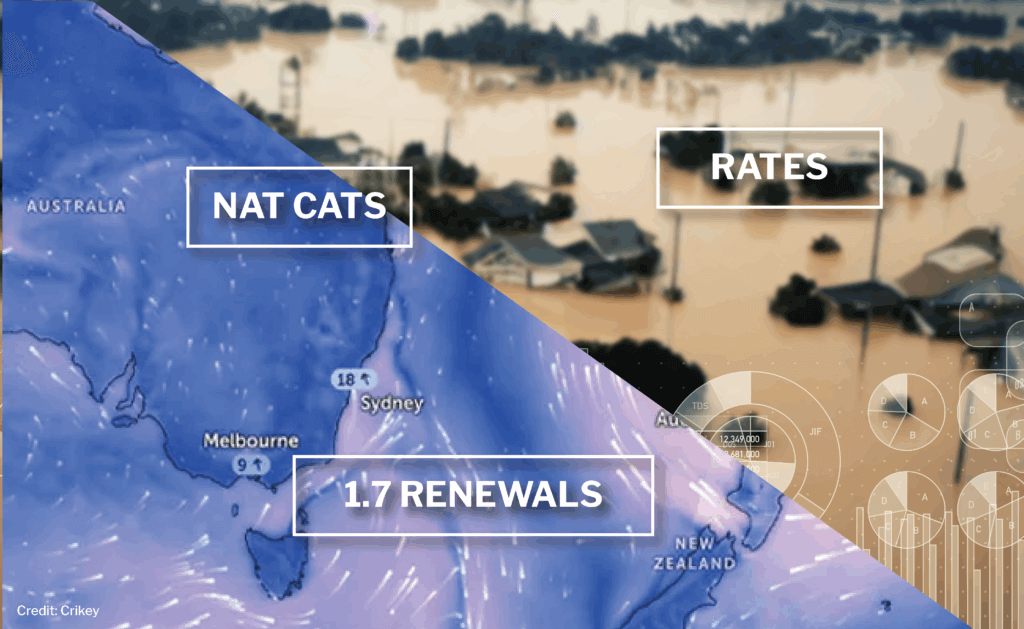

In the upcoming renewals, reinsurers show a preparedness to be flexible to a certain extent, but not to destroy the structures that have been built up since 2023, according to Franz-Josef Hahn, CEO of Peak Re.

“We cannot cling on to 2023 as a reinsurance industry, while our capacity is growing to historical heights,” Hahn said. “There is a strong interest among reinsurers to grow.

“On the property cat side, globally, reinsurers are prepared to see a slight reduction of rates, as long as it is rectified on risk-adjusted basis. But the structures which have been built in the years 2022, 2023 will remain – higher deductibles for the direct markets.”

While he said there is a room for flexibility on pricing, Hahn added: “We have seen slight reductions last year already, but there will be a limit and, risk adjustment is the key.

“I think the message is to stay disciplined both on the direct and on the reinsurance side. Stay disciplined and stay diligent.

“Certainly, there is a preparedness to get into discussions with our clients and to see what they need and to help them in finding the right solution.

“We try to understand what the pressure point is and we try to find ways we need to support them.”

“We're very happy with the way how we are operating. I don't think that we will bring too many changes to our existing book. We will want to grow the book as what we have.”

Franz-Josef Hahn, Peak Re

However, Hahn noted that though the reinsurer had pulled out from aggregate structures a few years ago, it is now prepared to do aggregates, “but there needs to be a sufficient deductible and sufficient pricing in order to get into aggregate risks”.

There is also a strong desire infor full transparency, he noted.

“Data today is much more important than ever before. And insurance companies want to see the full transparency of what is ahead,” he added.

“Technology definitely has helped. But also in general terms, reinsurers don’t accept risk blindly. And they want to have a full set of information given. And they would request this even from smaller companies.”

With the softer direct market and the demand for commissions, the reinsurance will definitely react.

“Reinsurers want to see full transparency before they can allow flexibility on terms,” he emphasiszed.

Expanding on the Hong Kong-based reinsurer’s plans, Hahn said that in general, Peak Re is very happy to expand on the basis what we have with our existing long-term clients.

“Discipline of underwriting and client relationships play a big role because with the existing clients we know exactly who we have and whom we want to deal with,” he said.

“We are not going to be everything for everybody.

“We’re very happy with the way how we are operating. I don’t think that we will bring too many changes to our existing book. We will want to grow the book as what we have.”

Personal lines play a big role in Peak Re’s portfolio following a restructuring in 2023, he said.

Discussing the reinsurer’s portfolio approach, Hahn said, “property and cat business was reduced in our total portfolio in order to rectify what we wanted to do in our appetite”.

“Casualty business has been growing, motor business has been growing, and personal accident and life has been growing. But the largest lines are still property and casualty, and they are the dominant lines all the way through. As well as credit and bond,” he added.

“What we have introduced in 2024 is structured solutions for P&C business, which started on life side in 2023. And that will be a strong driver of our life book as well as our P&C book,” Hahn noted.

These are solvency deals, very often low volatility, but capital effective for clients.

“I think they give more opportunities and leverage long-term relationships and partnerships which we have because it’s rounding up the opportunities which we have for our clients,” he added.

“So it’s an additional and a very strategically important issue to be involved in it.”

The majority of models used operationally in Asia Pacific do not account for the recent increasing frequency of extreme weather events, however, newer generation of cat models do have capability to produce alternative views which include loadings for climate scenarios, according to Mark Weatherhead, managing director and head of analytics for Southeast Asia and the Pacific at Guy Carpenter.

The models are based on a static “current climate state” view derived from analysis of historical data sets.

“When catastrophe models are built, typically, the hazard module is locked down first and then the model is calibrated. As such, there is a delay between when the hazard is set and the model is released,” said Weatherhead.

“In the past, this wasn’t a significant issue, and the models were considered fit for current near-climate modelling, but given the rate of change now observed, they fall out of date quickly.”

However, there is a balance to be found between stability of modelled losses and keeping models up to date, he said.

“The (re)insurance industry does not want or expect models to change dynamically every year to reflect the latest view on climate, as this would make it difficult to also understand and manage the effects of portfolio growth,” Weatherhead added.

“We need modelling of the baseline conditions to apply the adjustments, which can be difficult for Asia Pacific, where models don’t exist for all perils and countries.”

Mark Weatherhead, Guy Carpenter

Rather, the current expectation is that models will only be updated every three to five years.

However, Weatherhead noted that “there are still many demands on insurers to assess their climate risk for regulatory or strategic planning purposes”.

This is driven by local regulators requiring climate-risk assessments.

However, the challenges are that different regulators choose different scenarios, so there is not a single solution that can be applied everywhere.

“We need modelling of the baseline conditions to apply the adjustments, which can be difficult for Asia Pacific, where models don’t exist for all perils and countries,” he noted.

Guy Carpenter has developed flood models designed to allow for climate risk assessments for most countries, but there are still gaps for perils such as drought and impacts of excess heat and water shortage.

While secondary perils is a misnomer, as they are driving significant loss, Weatherhead said: “The challenge in Asia is that these perils have by and large not been modelled, with the exception of Australia.”

The difficulty is that many insurance companies in the region have not yet developed internal expertise and/or technical tools to transform the raw scientific data into something that can be used for business decisions.

The challenge, according to Weatherhead, is how “we address the gap in knowledge”.

“This will change in time, but for now there is a reliance on experience-based loadings and external advice,” he added.

The newer generation of models from the larger commercial vendors, while very welcome, are still limited in their coverage and aim mostly at the larger, more established markets.

While Weatherhead doesn’t see “too many problems with model credibility in the region, at least for the major countries and perils”, the bigger issue “is the quality of the data going into the models from the exposure side”.

“This is very mixed across the region. In some countries, detailed location-level data is the standard; in others, its data aggregated to province or even country level. However, we do see data improving every year,” he added.

Most insurance companies are working to improve their data, and there is a realisation that if they do not, they are at a disadvantage compared to their peers.

Location-level data allows for better representation of the splits between building and content values, and other secondary factors such as building height and construction.

“This can substantially change the modelling results and give a much-improved view of the risk,” he noted.

Scor expects an “orderly” 1.1 renewals process in Asia Pacific, with reinsurers facing pricing pressures following a benign natural catastrophe year in the region and an influx of capacity, according to the French reinsurer’s APAC head.

In an interview with InsuranceAsia News, Mukul Kishore, CEO of Scor Re APAC and head of P&C for APAC, said that the upcoming 1.1 renewal in the region is being shaped by “several factors.”

“Demand for reinsurance remains strong both in the mature markets and fast growth markets,” said Kishore. “The nat cat activity to date has been relatively benign. Improved capital position from recent good years will result in more capacity to be deployed. All of this means a more competitive market, but the underwriting discipline holds.”

Heading into 2026, reinsurers face challenges from the impact of climate change, ongoing geopolitical tensions between the US and its trading partners in APAC, which have impacted trade flows, and escalating political risk, such as the wave of Gen Z protests that have unfolded across the region this year, which caused the collapse of Nepal’s government.

“The risk landscape continues to evolve driven by climate change, geopolitical tensions, and trade & supply chain disruptions,” said Kishore. “These require agile adaptation and response to the evolving environment.”

At the upcoming 1.1 renewals, Scor expects an “orderly market,” with “adequate capacity and stable terms and conditions,” assuming that there are no major global loss events between now and the end of 2025, according to Kishore.

“Our appetite for Asian risks is evolving in line with market developments.”

Mukul Kishore, Scor

“There will be pricing pressure for well performing property cat programs, but we expect it to remain adequate for reinsurers to support the cedent needs,” said Kishore.

“We will continue to offer consistency to our clients in terms of capacity and will look to grow with them where mutually beneficial.

“This prognosis assumes no large global market events that redefines market appetite and pricing adequacy.”

After multiple strong years of returns following the last reinsurance market cycle in 2023-24, reinsurers in APAC have amble capacity to deploy, which is fuelling intense competition in the region between reinsurers, creating a buyers’ market, in which reinsurers must remain disciplined on rates and terms and conditions.

Nevertheless, Scor expects cedent retentions to be “stable, especially on cat programs.

“At the expected pricing adequacy there will not be any dearth of capacity at renewals,” said Kishore. “The reinsurers will remain disciplined on the terms and conditions, particularly around exclusions, retentions, limits and the attachment point.”

Heading into 2026, Scor sees strong opportunities in “diversifying lines,” including engineering and marine, and alternative solutions, such as structured solutions for solvency management, earnings protections, and parametric reinsurance, according to Kishore.

Kishore added that APAC remains “central” to Scor’s 2026 strategic plan, known as Forward 2026, which was unveiled by Scor CEO in July 2024 after the French reinsurer took large losses on its L&H book, triggering a profit warning.

Under its current strategy, Kishore said that Scor is “prioritising diversification and disciplined expansion in preferred lines,” with APAC’s “dynamic market” offering “significant opportunities for profitable growth.”

“Our appetite for Asian risks is evolving in line with market developments,” said Kishore. “We are maintaining a prudent approach to climate-exposed and US casualty business, while expanding in diversifying lines of business and alternative solutions where technical profitability and innovation are strong.”

The next JPY1 trillion (US$6.6 billion) catastrophe loss year is not a matter of if but when. The industry is increasingly focused on proactive resilience – leveraging scenario modelling, visualising exposure and underlying risks both at macro and micro levels and advocating for greater insurance penetration to narrow the protection gap, according to Atsuhiro Dodo, head of Japan, Swiss Re.

“In Japan, demand for natural catastrophe insurance continues to grow, driven by heightened risk awareness following recent quakes, and by inflation which has pushed up wages, repair and reinstatement costs, and consequently the valuation of property assets,” Dodo said.

The growing risk of secondary perils such as hail, flash floods and localised windstorms are becoming a larger share of Japan’s natural catastrophe losses. In 2024, severe convective storms (SCS) drove record insured losses of around US$1.3 billion, the highest ever recorded for Japan, he noted.

“These events highlight how rising urbanisation and the accumulation of valuable assets in hail-prone and flood-exposed areas are amplifying risks.

“These trends have prompted a more granular approach to underwriting, with a focus on location-specific risk selection and refined accumulation controls, for instance by sub-perils,” he said.

Swiss Re, Dodo noted, “regularly updates its proprietary models to ensure the view adequately reflects our current risk landscape, while also developing data/tech-driven innovations that support proactive risk mitigation with location intelligence data”.

Japan has been successful in offering and developing one of the most advanced and data-driven cyber insurance markets in Asia Pacific, he noted, adding that it has been fast growing over a decade and still has high potential – particularly among SMEs.

“We are part of this growth journey. We support fulfilling customer’s increased risk awareness in cyber and offering technical exchanges for the sustainable growth of the market.

“Future success will hinge on the industry’s ability to close the SME protection gap.”

Outside of cyber, Dodo said: “We observe clients taking a more prudent approach to line size management and risk selection both in domestic and international markets.”

“Clients also pay a close attention to terms and line size in liability business, particularly given the impact observed from liability claims inflation in the US. They anticipate potential future impacts from rising litigation costs.”

Atsuhiro Dodo, Swiss Re

While the initial driver was to address the underperforming domestic property market, he said: “This approach has since expanded to interests abroad exposures, following the industry’s recent experiences with large-scale events such as the floods in South Africa and wildfires in Hawaii and LA.

“Japanese manufacturing companies, which have steadily increased their foreign direct investments since 2000, now have significant overseas exposures.”

“Clients also pay a close attention to terms and line size in liability business, particularly given the impact observed from liability claims inflation in the US. They anticipate potential future impacts from rising litigation costs,” he added.

Japanese insurers remain active acquirers, being highly capitalised and liquid while under regulatory pressure to unwind cross-shareholdings.

This coupled with limited domestic growth opportunities, has fuelled strong inorganic expansion overseas, particularly in the US and in specialty insurance lines.

Excluding one-off profits from selling off cross-shareholdings, 60 to 70% of underwriting profits for the three mega insurance groups in the last fiscal year came from overseas entities.

Dodo said: “This is a transformational change over a decade which has implications on many aspects including retention strategy and reinsurance purchase. We listen to clients and keep pace with their moves and aspirations.”

“Reinsurance can also be considered as an alternative to own capital and a strategic enabler for M&A.

“It frees up regulatory capital, while legacy deals such as portfolio transfers can release trapped capital. Retrospective reinsurance such as adverse development covers help carriers divest or ring-fence old and long-tail portfolios, accelerating capital release that can be redeployed into acquisitions.”

“We are addressing reinsurance integrated into the transaction process, which helps increase alignment between buyers and sellers and mitigate the risk of adverse post-acquisition outcomes,” according to Dodo.

Clients have got choice for the first time in a few years with the market in a much healthier position this year on the build up to the renewal, said Mark O’Brien, managing director and head of Asia Pacific at Gallagher Re.

“The sector is in a much stronger position than in recent years, creating more options for buyers. We’re not close yet to being back to where we were pre-2023 when the market turned, but we’re slowly getting that way,” O’Brien said.

“I think that there’s for sure a willingness on the reinsurer’s part to consider what clients are trying to achieve.

“Reinsurers are in growth mode. So now results have improved, markets healthy and vibrant again, reinsurers are looking to grow and the moment that happens then you do trigger competition.”

This renewed competition has already led to a noticeable softening during 2025, and O’Brien said it is not “unreasonable to assume that the softening will continue into the 1.1 renewal”.

“There’s for sure a willingness on the reinsurer’s part to consider what clients are trying to achieve,” he said.

This shift is evident in the proportional reinsurance market in Asia, which O’Brien noted has been “challenged for a couple of years”.

He attributed past difficulties to soft primary markets, which forced reinsurers to protect their margins by tightening terms and conditions, including introduction of “long sliding scales of commission, tight event limits, loss caps, [and] loss participation clauses”.”

With improved underlying results, the pressure is now easing. “Clients are putting a lot of pressure on reinsurers to relax some of the stringent conditions that were imposed on them,” O’Brien said, adding that clauses like loss participation clauses and loss corridors are already being relaxed.

However, he does not expect a wholesale rollback. “I don’t think we’re necessarily going to see a relaxation of event limits,” he added, noting that natural catastrophe losses in Asian proportional contracts have been a persistent concern.

Structured solutions are emerging as a requirement for Asian carriers, who have traditionally “historically bought quite low down”, to sustain frequent losses at the lower end of the program and reducing volatility of their balance sheets.

“I don’t think there is a natural willingness for the reinsurers just to drop back down again. I think that really is still a space for bespoke customised structures,” he said.

“The appetite to deploy capacity at that level has increased. But it has to be bespoke and it has to be structured.”

“Most insurance companies in particularly in the Southeast Asian region would buy beyond what the model would suggest. There isn't a set prescribed guideline in some territories.”

Mark O’Brien, Gallagher Re

Gallagher Re has done an “awful lot of work around bespoke structures that sit in that area”, he added. What reinsurers have done in conjunction with Gallagher Re is look at multi-year structures.

These sophisticated, multi-year arrangements are proving effective for Asian clients. Detailing how these structures help, O’Brien said: “The recognition of reduction in volatility is brought through the structure by a profit commission.”

This mechanism allows clients to crystallise profits in good years or maintain coverage terms after a loss. “It gives them certainty,” he added.

For reinsurers, these deals are about more than just a single transaction.

“Reinsurers are actually increasingly recognising that it’s a strategic partnership,” O’Brien explained.

“By offering that capacity and offering that structure, they have got a long-term partnership with that buyer,” which in turn provides access to other parts of the client’s portfolio.

Looking at demand growth across the region, O’Brien does not anticipate a “sudden surge” in limit purchases in Asia, ex-Japan.

“Most insurance companies in particularly in the Southeast Asian region would buy beyond what the model would suggest. There isn’t a set prescribed guideline in some territories,” he noted.

Meanwhile, consolidation and diversification are likely to drive some growth.

He pointed to markets like Indonesia, where regulatory changes are driving M&A activity, as a key area where reinsurance “will really come into the fore.”

“Reinsurance can be used to de-risk portfolios during a sale or to support the capital requirements of newly combined entities,” he added.

For more mature insurers, the focus is on growth beyond saturated home markets.

“A lot of the insurance companies are quite saturated, competition is high so they’re looking for either product diversification or territorial diversification,” O’Brien said.

Gallagher Re is actively supporting clients in this endeavour, whether by helping them build out new product lines like cyber or renewables, or by diversifying portfolios MGAs.

“We’re going through this phase at the moment that’s quite exciting in the next five years,” O’Brien said.

Gallagher Re is targeting organic growth and strategic acquisitions to solidify its market position in Asia Pacific, according to Mark O’Brien, managing director and head of Asia Pacific.

Gallagher Re wants to be the “go-to broker” through high-profile hiring and complementary M&A.

“We’re always looking to grow,” O’Brien stated, setting the tone for the company’s ambitious agenda. “On the people front, we are always looking to add quality individuals to our organisation and we’re looking to add complementary businesses.”

He emphasised that organic growth remains the “primary growth engine,” driven by expanding the firm’s offerings in key areas.

“Whether that’s through market share, expansion of our life and health offering, renewable, casualty or cyber, there’s a lot of organic growth that we’re trying to achieve in the region,” O’Brien said.

A critical component of this organic push is assembling elite client teams.

“We are trying to put together the best client teams that we can,” he explained. “Part of the reason for the sort of high profile hiring that we’ve done is in order to achieve that. We want to be the go-to broker for everybody in the region.

“Organic growth will only get us somewhere, so we’re looking to see if we can embed in some complementary businesses around the region and that’s where the M&A comes in.”

Earlier this year, Gallagher Re bought Australian broker Steadfast Re and acquired a Chinese licence through an acquisition. It also reached an agreement to take 100% control of the Japan P&C cedent facultative portfolio from JV partner Miller.

“India, Thailand are great examples of where we're going to be looking to invest and grow our portfolio business.”

Mark O’Brien, Gallagher Re

“I think over the next five years you’ll probably see more activity by Gallagher Re on the M&A side,” O’Brien projected.

The growth strategy will be tailored to the diverse markets within the region.

While he noted that “Gallagher Re is very strong” in Southeast Asia, with a goal to “consolidate and grow,” he described China as a market where the company is “just getting started”.

“We’ve got a fabulous portfolio business, an incredible team. We’ve got our platform ready and we’re going to grow that market,” he said of its Chinese operations.

Looking at other key territories, O’Brien identified significant potential for expansion. “If you then think [of] some of the other larger markets, Korea, India, Thailand… our footprint isn’t quite as large as we’d like it to be.”

He named India and Thailand as prime targets for investment.

“India, Thailand are great examples of where we’re going to be looking to invest and grow our portfolio business,” O’Brien said, clarifying that this expansion would be achieved “through acquisitions of people and companies.”

“Gallagher is a growth organisation, and Gallagher Re has been tasked with growing that market share.”

Laurent Montador, deputy CEO of Arundo Re, speaks to InsuranceAsia News ahead of the upcoming 1.1 renewals in APAC.

The existing market players provide sufficient capacity and also there is an increase in non-traditional reinsurance through ILS marketplace. So, this adds through existing traditional reinsurance to the capacity. But the demand is also growing as the risks.

Cedents need more cover and so it’s on the top of existing covers, there is also inflation, and there is also additional aggregation of insured values.

There are some forces to go with lower priorities. For us, it is very important to remain disciplined with the structure. We don’t want to return to times where we had lots of aggregate covers, not knowing exactly which type of losses could inure to those covers, and with many unknowns.

We really have to be disciplined on that. Reinsurance is clearly there for capital losses but not absorbing the full volatility of earnings losses, only a reasonable portion of it.

We can do some proposals on that, but clearly not with multi-line, multi-year, multi-aggregate cover with lots of unknowns and lots of unmodelled perils.

Markets have reacted differently with the need to reassess risk in 2023. And Europe is different from Asia.

On the property cat, there is smaller possibilities to have a decrease and softening of the pricing as the hardening has been lower. Climate change has also different effects even if the same rules apply: warmer air holds 7% more water per degrees Celsius.

On the property cat, there is smaller possibilities to have a decrease and softening of the pricing as the hardening has been lower. Climate change has also different effects even if the same rules apply: warmer air holds 7% more water per degrees Celsius.

We expect more intense typhoons, with intense rainfalls and sea level in the Pacific and Indian Ocean are rising faster than the global average.

Also, in Asia, monsoons are expected to be more erratic and intense with widespread flooding and landslides. No, I don’t think there is room to get lower rate on line.

In the other lines of business, it is something that is very case by case.

We operate in this region and it is a very large part of our portfolio, so we put a lot of people and energies in these markets.

We continue to see potential growth in mature markets like China, India and South Korea for example, and to a lower extent Singapore and Japan.

We continue our growth in other markets like Vietnam, Thailand and Malaysia. Our forecast for the Asia region overall is still double-digit growth, we really want to continue to grow with our clients.

We will have again an increase in capacity on our cat exposure this 2026 renewal.

We will continue to grow in Southeast Asia.

It won’t exactly be the same [as January 2025]. It will be globally at the same pace overall.

Our business model is to do the underwriting from Paris with international teams with strong links with their markets and clients. We think we can continue to grow and grow with our clients and brokers.

We are keen to diversify in others Asian markets as well, especially through cross fertilisation with P&C clients.

For us, it is controlled growth with a well-balanced portfolio.

What is important for us is being able to generate profits overall through international mutualization and managing the cycles to put additional capital to better serve our clients in the future.

Asia-Pacific (re)insurers are navigating a nuanced regulatory environment in 2025, including selective easing of capital requirements, enhancement of volatility buffers, and heightened expectations for capital quality, governance, and consumer outcomes, according to Kanishka de Silva, director at Fitch Ratings.

“Fitch Ratings expects the changes to balance insurers’ resilience with growth, reduce their pro-cyclicality and strengthen consumer outcomes, but they also introduce execution risks and potential earnings volatility for (re)insurers,” he said.

Specifically, in China, State Council Information Office has announced a 10-percentage-point cut to equity capital charges under the C-ROSS framework. This, along with the phase 2 transition, which was extended to end-2025, should increase solvency headroom and support longer-duration investing, particularly for life insurers, said de Silva.

The regulator has also guided large state-owned insurers to allocate around 30% of new annual premiums to A-shares from January 2025.

“These measures aim to deepen domestic market liquidity and anchor investment horizons, but they also increase the need for disciplined asset–liability management (ALM), rigorous stress testing and effective hedging, given potential equity market volatility and liquidity stresses,” he said.

Meanwhile, South Korea has lowered the K-ICS minimum capital adequacy benchmark to 130% from 150%, and extended the timeline for adopting the revised liability discount rate. Insurers will be required to apply the 30-year bond rate from 2035, instead of 2027, easing near-term capital pressure and funding costs and providing insurers flexibility to adapt to the new regime.

Yet, according to de Silva, stricter core capital ratio rules, due in the second half of 2025, and the duration gap indicator, effective from 2027, will be a stronger test of resilience and could sharpen differentiation.

“The change will dampen fire-sale risks during stress and lean against exuberant phases, while preserving strategic asset allocations.”

Kanishka de Silva, Fitch Ratings

“(Re)insurers reliant on weaker forms of capital or lacking robust ALM discipline may face tightening constraints, while those with high-quality capital, diversified investments and clear risk appetites are likely to navigate the transition more smoothly,” he said.

Smoothing market cyclicality is evident in policy updates across the region, the director added. Singapore introduced an equity counter-cyclical adjustment, calculated using monthly average year-on-year returns, that is designed to temper swings in capital strain.

“The change will dampen fire-sale risks during stress and lean against exuberant phases, while preserving strategic asset allocations,” said de Silva.

Elsewhere, Taiwan’s transitional measures ahead of full implementation in 2026 of the Insurance Capital Standards and IFRS 17 will help insulate solvency from currency and measurement shifts, he added. These measures span averaged FX rates, updated reserving assumptions and strengthened FX fluctuation reserves.

Access to risk transfer is broadening, with capital frameworks adapting to market conditions, according to Jessica Pratiwi, an associate director at Fitch Ratings.

The Australian Prudential Regulation Authority’s (APRA) ongoing reinsurance consultations, which now include removing reinstatement requirements, aim to expand protection capacity and make alternative reinsurance arrangements, such as cat bonds and ILS, more attractive.

“In the non-life sector, stricter commission controls for non-motor lines are shifting competition from commission-led acquisition towards risk-based pricing and disciplined underwriting.”

Jessica Pratiwi, Fitch Ratings

“Building on the same balance between rigorous risk management and appropriately calibrated capital, APRA’s consultation on annuity products seeks to revise the illiquidity premium, potentially lowering capital requirements for insurers with closer asset–liability matching and robust risk controls and paving the way for more competitive retirement products without compromising policyholder protection,” Pratiwi said.

Conduct and sales practices are also in focus, she added.

Specifically, Hong Kong’s new 50% benchmark on broker referral fees for participating policies, with enhanced disclosures when fees exceed the threshold, aims to boost transparency and reduce conflicts, even if intermediaries need to recalibrate economics in the near term.

In China, the National Financial Regulatory Administration has promoted the transition to floating-income products (participating), and stricter commission controls for the agency and broker channels.

“In the non-life sector, stricter commission controls for non-motor lines are shifting competition from commission-led acquisition towards risk-based pricing and disciplined underwriting,” said Pratiwi.

Meanwhile, in Indonesia, impending higher minimum equity requirements are likely to prompt consolidation of the fragmented (re)insurance market as weaker insurers are likely to be acquired in the absence of capital injections, she said.

The country’s Financial Services Authority will raise the minimum equity requirements for (re)insurers in two stages that are likely to come into effect by end-2026 and end-2028.

Asia Pacific remains a key component of Beazley’s growth as the UK specialty insurer continues to focus on building out its specialty offering in the region, according to its head of APAC Jessica Schappell.

In an interview with InsuranceAsia News, Schappell said that the specialty insurer expects “more of the same” in the upcoming 1.1 renewals compared to January 1, 2025.

“From a catastrophe perspective, worldwide it has been a relatively benign year,” said Schappell. “Asia has had its fair share of cats including earthquakes, typhoons, and there has been some civil unrest in there too. “

“We probably won’t see the market dynamics change much from what we’re currently seeing now in terms of an influx of capacity,” added Schappell. “There is a lot of choice for clients when they’re looking at who to place their insurance with.”

Over the last three years, Beazley has invested heavily in growing its specialty offering, particularly cyber insurance, which has been a critical source of premium growth for the Lloyd’s insurer.

In the first half of 2025, Beazley wrote US$544.3 million of cyber premiums globally, equivalent to around 17.1% of its US$3.18 billion of premium, and the third largest source after property and MAP risks.

The division is also one of the insurer’s most profitable, with a combined ratio of 68.9% the first half, compared to 78.7% for property risks, 88% for specialty, 62.5% for MAP risks, and 70.9% for digital risks, according to Beazley’s annual results.

Cyber underwriting was a key component of Beazley’s record underwriting result in 2024, with cyber making up US$1.27 billion of Beazley’s US$6.16 billion premium last year.

Beazley sees a large structural growth opportunity for its cyber business in APAC, which is an underpenetrated region for the product, with recent large scale cyber attacks on corporates such as Jaguar Land Rover in the UK and Asahi in Japan driving awareness of the escalating risks corporates face from cyber threat actors.

“It is no surprise that cyber risks have been one of the top concerns since 2022, and that is showing no signs of abating heading into 2026.”

Jessica Schappell, Beazley

“Asia Pacific plays an important role in our growth strategy,” said Schappell.

“Next year is our twentieth anniversary in Asia and we have certainly seen an evolution of the business over the last nineteen years where we were predominantly construction, property, marine and a little bit of PI. Over the past six to eight years, we have made a lot of effort to bring our specialist products into the region.

“Cyber of course is one of our largest pillars, and that is no different here in Asia, representing a quarter of our business in the region,” added Schappell. “There is a lot of penetration to go which is creating opportunities for specialists in this asset class.”

The volume and sophistication of cyber attacks in APAC are growing, fuelled by the rollout of AI technologies. According to Beazley’s recent Risk and Resilience report, 26% of surveyed executives in Singapore cited cyber risk as their greatest threat in 2025, up from 24% in 2024.

“It is no surprise that cyber risks have been one of the top concerns since 2022, and that is showing no signs of abating heading into 2026,” said Schappell.

Many jurisdictions in APAC have recently strengthened or enacted new cyber security laws, including Japan, Singapore and Hong Kong, which is increasing the need for corporates to insure themselves against cyber breaches.

“Our main message ahead of SIRC is that while there are challenges in the region, we see huge opportunity for growth in APAC across our cross class, specialist solutions,” said Schappell.

“As regulations become more mature and as incidents become more public, potential clients will see the value of cyber insurance.”

Rising insurance penetration and growing need to close the protection gap across both life and non-life segments will fuel growth for reinsurers in Asia Pacific, according to Ahmad Noor Azhari Abdul Manaf, president and CEO of Malaysian Re.

“In Malaysia, robust infrastructure and healthcare projects, ongoing healthcare financing reforms present opportunities for (re)insurance,” he said.

“Across Asean, demand for emerging specialty classes such as cyber, health, and climate-related insurance continues to increase as businesses and governments strengthen their resilience efforts.”

Meanwhile, the APAC reinsurance market, including Malaysia, is expected to remain generally soft over the next 12 months, supported by abundant capital and heightened competition among reinsurers

“Pricing momentum will continue to favour cedents, with greater flexibility expected in negotiations. The overall market environment should remain stable, aided by relatively mild catastrophe activity in early 2025,” said Ahmad Noor Azhari.

However, reinsurers will need to continue navigating a complex risk landscape.

“Challenges include increasingly soft market, pricing, heightened climate and catastrophe volatility, evolving regulatory frameworks, and demographic shifts that are reshaping longevity and healthcare financing. Geopolitical and trade uncertainties also require careful management,” he said.

“These dynamics call for careful portfolio management and a measured approach to balancing growth with long-term resilience.”

Meanwhile, for cedents, concerns lie in not only pricing volatility but also structural developments within each market, according to Ahmad Noor Azhari.

“In the short term, we believe that cedents are likely to remain concerned about pricing volatility across different lines, inflationary pressures, and the adequacy of coverage for emerging risks like cyber and climate-related perils,” he said.

“Over the longer term, cedents are watching several structural developments with caution. Key among them is evolving regulatory frameworks, such as solvency requirements and the rise of climate-related disclosure requirements, which will influence capital management and underwriting practices.”

Besides, rising cat volatility worldwide, geopolitical uncertainties and trade disruptions, which will affect underwriting margins and portfolio strategies, are also weighing on cedents’ minds, he added.

Despite increasing competition and softening market conditions, Malaysian Re’s strength lies in deep local knowledge and strong relationships, according to Ahmad Noor Azhari.

“As the largest reinsurer in Malaysia and the leading national reinsurer in Asean, we have built strong partnerships with local and regional insurers and reinsurers, giving us both scale and credibility in the markets we serve,” he said.

“Our retakaful division continues to lead innovation in this growing segment, while our active involvement in national initiatives has strengthened our legitimacy and trust among regulators and industry stakeholders.”

“Regionally and internationally, we are increasing our footprint across Asean and selected markets in Europe, the Americas, and Oceania.”

Ahmad Noor Azhari Abdul Manaf, Malaysian Re

The reinsurer will continue expanding its international footprint will strengthening its domestic services.

“Domestically, we will keep investing in national schemes and partnerships that reinforce market resilience, such as agricultural protection, Perlindungan Tenang, and other financial inclusion and risk-pooling initiatives.”

Perlindungan Tenang is a national initiative of Malaysia that aims to expand the availability and quality of insurance and takaful solutions to meet the needs of the unserved and underserved segments of the population.

“Regionally and internationally, we are increasing our footprint across Asean and selected markets in Europe, the Americas, and Oceania,” he said, adding that the company is also diversifying into growth areas such as specialty lines, family retakaful, facultative protection, and cyber reinsurance.

Across Asean, Malaysian Re will maintain leadership in collaborative efforts, including the Asean Renewable Energy Pool (AREP) and technical workshops that help partners build capability and address emerging risks such as climate and renewable-energy exposures, Ahmad Noor Azhari added.

“We will continue doing what we have always done, which is standing by our cedants and supporting them through changing market conditions,” he said.